It was in downtown San Francisco earlier this year when the idea of this piece originated. I was meeting a friend from a global growth fund and the two of us were bantering about our POVs on tech and startups. As he always does, he put this question across me that I think I still haven’t been able to fully answer.

Why only India is seeing B2B unicorns and no other economy? Hmm. There is an interesting question I am going to be thinking about for the next couple of weeks if not months, I thought to myself.

And I did. And for months. And every single time we at Sparrow looked at a B2B startup.

This is a multi-part essay as it was too much to cram in one piece. In Part 1, we want to cover the macro view and talk about identification of B2B opportunities and axes of value creation. Later in Part 2 and 3, we will specifically deep dive into micros — the numbers, the categories etc., and as well as into business model choices and what it means for sustainable competitive advantage.

If you have read my work before, you know this is a long article. So, beware! Let’s dig in if you are up for it.

What is really B2B

Companies that have a B2B (business to business) model form a very important part of our economy. These companies form the key and upstream elements of any supply chain; think, manufacturing, trading of goods, services, and among other things, cloud infrastructure.

As technology continues its crusade of disrupting consumer focused markets and business models, its presence is also being felt in the B2B arena. From helping a supplier expand into newer markets — topline improvement — to delivering a product.

Every block led to new B2B business opportunities

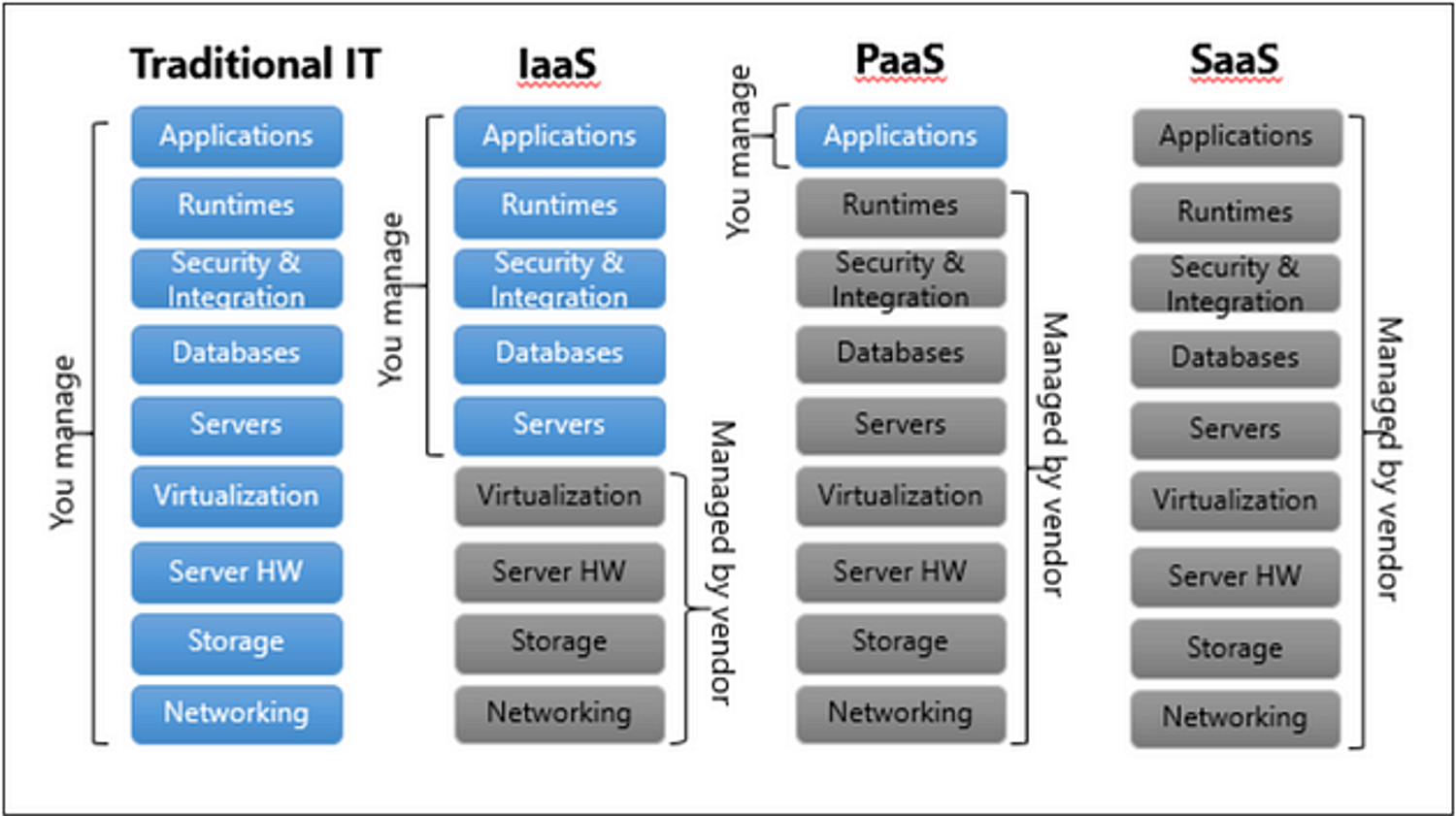

It was this kind of disintegration that led the transition from IaaS, PaaS to SaaS, as seen from the Exhibit (source) above. Essentially, every layer of disintegration allows for a new wave of B2B companies. Amazon for IaaS. Google for PaaS. Salesforce for SaaS.

Now we are seeing the same within SaaS alone; where there are individual vendors which provide modular components to another SaaS vendor. For example, Twilio which provides communication APIs, so developers do not have to build from scratch. Another example could be of Zapier which allows integration with other tools. Integration itself has become a module.

Software changed from being a vertically integrated industry to become a horizontal industry through modularization. Disruption

We think a similar wave is coming towards products (think, tangibles) side of B2B business, well at least in India. The same level of modularity will help us explain the need for B2B commerce & B2B solutioning opportunities outside of software — supply chains, trade finance etc.

Now, for the purpose of this read, let`s just broadly call these opportunities ‘B2B,’ and leave the Software bit alone & let it be SaaS. Analogy time over! Sorry!

Modularity allows for disintegration

The Hyundai Creta which is one of the most popular cars in India would typically have about 5–6k+ components which are sourced from more than 70–80 suppliers all over the world. Many of these components are modules which the OEM procures and readily uses instead of designing and manufacturing by themselves. Each of these modular component or ‘modules’ is a B2B opportunity. With tailwinds around the adoption of EVs, the auto industry is touted to see even more modularity.

From startups working on battery chemistry, to powertrains, and to the software that will be built on — a dominant CAR OS of the future. It is the same modularity the brings companies such as Apple with no industry background to think about building cars, and potentially, disrupt the industry.

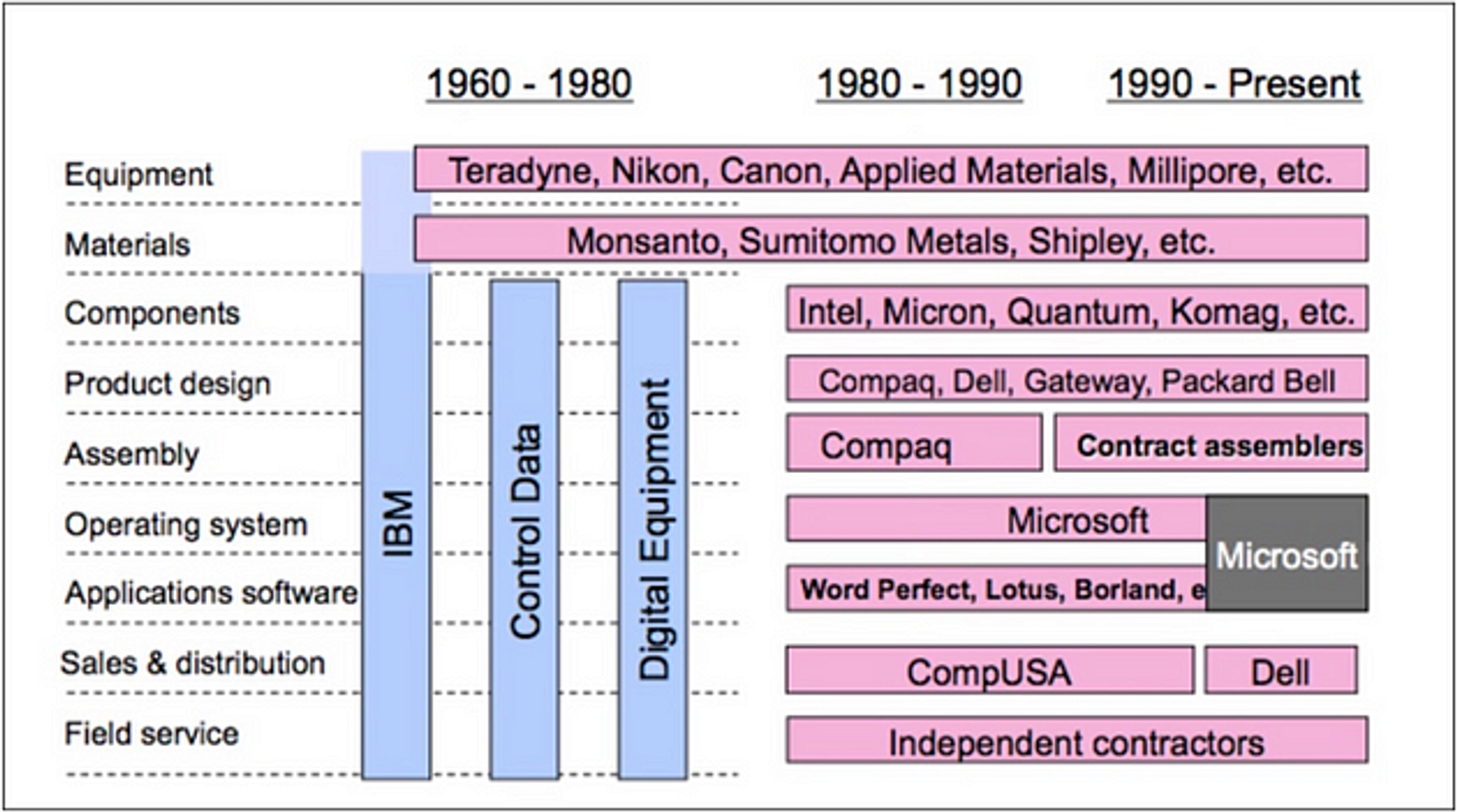

This was already happening way back in 1980s in the PC industry, as shown from the Exhibit below. when a vertically integrated IBM — which built everything in house, was disrupted by modularization, to become horizontal. B2B businesses emerged with most dominant ones being Microsoft — the dominant OS provider and Intel — the dominant chip provider. Even new businesses models emerged, like those of Dell which promise customization thanks to interoperability of PC components.

Source: Technology Strategy class by Professor Marc Knez at University of Chicago Booth School of Business

China led the way in showing the world how to produce standard & modular components and become the factory of the world. Today, outsourced manufacturing has become a (reliable) OPEX activity than CAPEX.

With Software really eating the world, and shaking business model designs, new B2B opportunities (through underlying modularization) are emerging, and India is poised to take advantage.

Modularity makes this possible!

The India context

As seen from the Hyundai Creta example above, we can clearly see how many separate component businesses exits — supplying spare parts, accessories etc to Hyundai. In fact, this has been around for ages. I purposefully bought this into picture so we can easily relate how modularization works and is at play in many other industries around us.

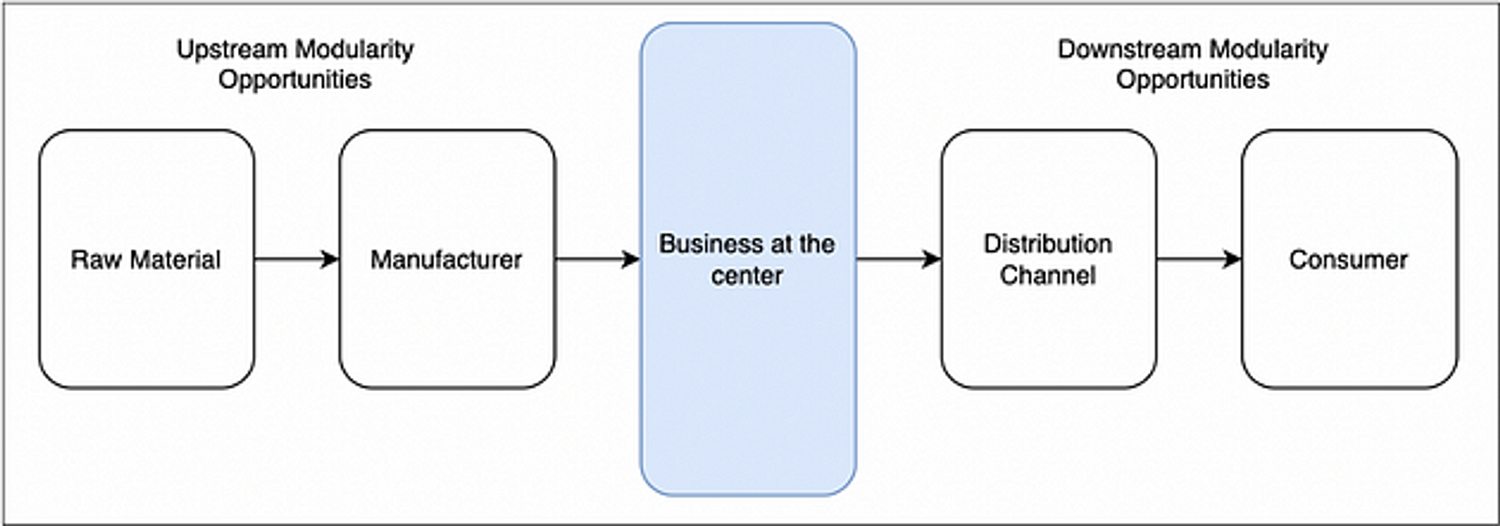

Let us take a typical industry value chain at play in many sectors around us. As we see in the exhibit above, how raw materials move to become finished goods in the hands of consumers, with the business being at the center and being an orchestrator of this value chain in terms of demand & supply planning, pricing, etc.

A company or a sector is said to be vertically integrated if a company(s) usually control many activities. They become horizontal when they decide to outsource a business activity. Or the industry itself sees changes where a business activity can become completely modular in nature, compelling the participants to act.

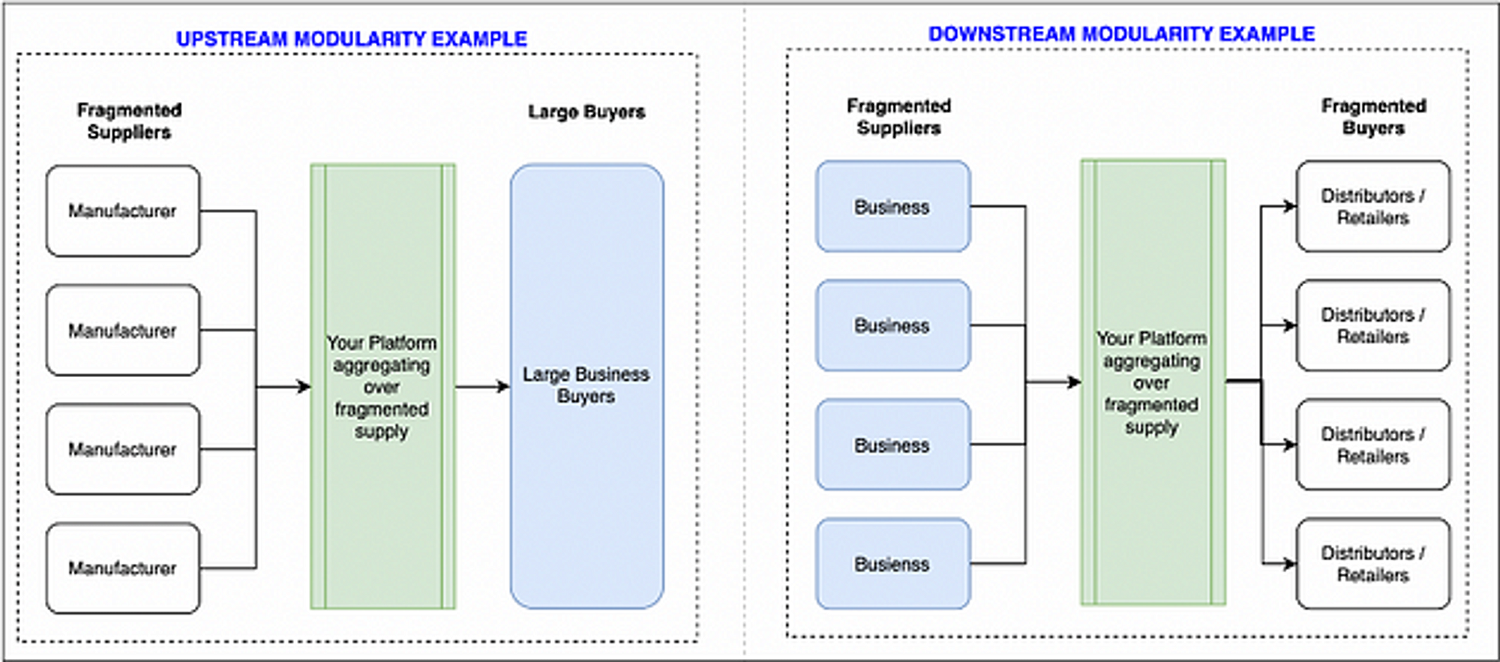

Such level of modularity brings B2B business opportunities. A B2B business may provide manufacturing capabilities to a business; we call this an example of upstream modularity. Then there are B2B businesses that help companies run better distribution operations; this is an example of downstream modularization.

Note that this level of modularity already exists. There are factories already providing manufacturing to businesses and distributors aiding business in their demand network planning. What is novel today is that technology is going to disrupt these existing, often fragmented, and dare I say, inefficient businesses.

They could complement them, short term, or replace them over the long term. This is the India context that is exciting and much of what drives our and startup industry`s excitement.

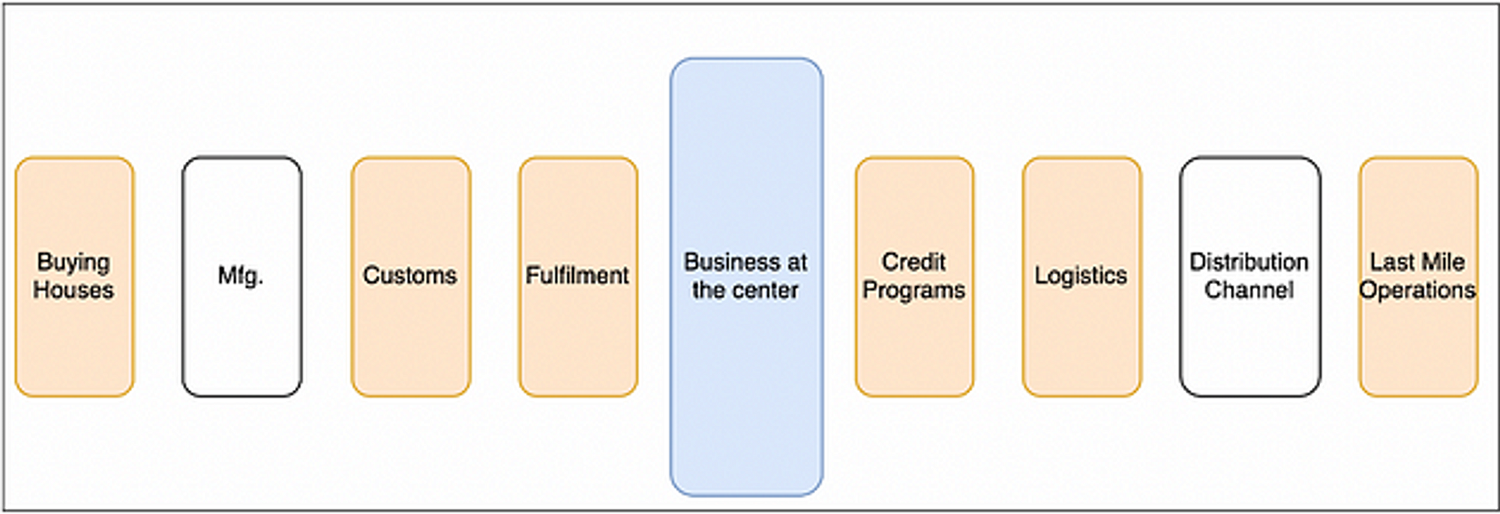

Our portfolio company Groyyo operates in upstream modularity, essentially making manufacturing in the apparel industry plug & play with smaller factories. Another portfolio company Depo24 is an example of downstream modularity which is building a new-age distribution channel for Home Improvement market.

Further, we think that technology enables new business models and new modularity in the value chain, at scale. Thus, more B2B opportunities. Essentialy, a logistic and trade finance company which is looked from LogisticTech and Fintech lens are examples of B2B businesses than can be explained from broader underlying trend around modularity, as seen below in the Exhibit.

D2C brands and adjacent business models are gaining traction because of modularity. Lots of components of upstream and downstream value chain are modular in nature, reducing time to market significantly.

The value vectors of evaluating a B2B business

At Sparrow Capital, we talk a lot about which value vector(s) a particular business will be built on. Is it price, quality, and among other things, convenience. Or a combination of value vectors?

For us, it’s an important way to understand what capabilities the founding team will have to invest capital into. It brings focus in capital allocation decisions. We are going to talk about value vectors a lot in investment theses and research.

In the B2B context, we think the following value vectors are at play.

1. Credit: When you are helping a business improve its AP and AR by extending credit to suppliers or channel partners. This is helpful when businesses do not want to underwrite credit risk to a section of stakeholders. Example, FMCG.

2. Price: When you are providing something cheaper than what is the next best alternative either by genuine business model innovation or at the expense of discounts, hoping customers will eventually move to you, valuing convenience. Example, Imports.

3. Fulfillment: When you make fulfillment more efficient and transparent, for example those in exports or when you build fulfillment capabilities for complicated supply chains, for example, those requiring cold storage or high value products. Example, Fruits and Vegetables or Jewelry.

4. Discovery: When you help businesses discover new suppliers or provider better discovery to its customers or downstream stakeholders. This is usually helpful when a category has large SKUs, customization, and high catalogue turnover. Example, Fashion

5. Quality: When you help a business achieve modularity/outsource in categories where quality is very important for doing business with stakeholders. Example, Specialty chemicals

More importantly, I would also add that the above list is a pecking order with Quality being of highest importance than Credit. We see that the role of technology becomes even more important in solving for value vectors such as Quality and Discovery. For example, solving for quality using technology in an industry which relies on manual checks is non-trivial. So is building for discovery in a tech product — think 1000s of searchable SKUs, digitized catalogue, etc.

B2B businesses operating in categories where, for example, Quality and Discovery are primary value vectors will typically see high gross margins. For example, in specialty chemicals, GMs could range between ~30–40%. Combined with technology, these businesses shall have long term sustainable competitive advantage and such companies will command premium over others.

Expect lower GMV multiple if your primary value vector is Credit versus a premium if you solve for Quality. Technology really seems to add lot of leverage here and make them venture backable.

In a category, multiple value vectors are at play and thus it is important to understand what the pecking order of importance in your business model is.

Fragmentation further enhances the role of technology

When you have narrowed down categories to look for B2B opportunities, we recommend picking those which are highly fragmented on the supply side, the supply being your (the B2B platform`s) suppliers. I have listed two examples of such business models on both upstream and downstream side.

When you work with fragmented suppliers, for example, smaller factories, there is lot of value you can bring to large buyers by brokering trust and Quality, which they have found it harder to do without you. In some categories, you could also be enabling smaller suppliers (factories) to meet large MOQ demands (Fulfillment), provide / enable access to credit to meet working capital needs (Credit), and be competitive than others due to aggregation (Price). Groyyo does this.

Like I said, multiple vectors are at play, but it is very important to know which one is of most importance to your buyers. At the same time, you can’t be great on Quality but be off on Price by being expensive; Price must be table stakes at the very least in this case.

Similarly in downstream, you could be working with multiple smaller businesses to enable their distribution. This is often true when you have fragmented categories such as Home Improvement in which large players have single digit market share apart from a few including Asian Paints. In here, you would be enabling Discovery of many SKUs and brands to the retailer or the distributor, that they have not had access to. You are also solving for Fulfillment by enabling these smaller brands to plug into your supply chain to supply smaller orders in geographies where they do not have large presence. Depo24 does this.

It is also important to talk about an unfragmented or consolidated supplier base. In our view, when that happens, Credit becomes most pronounced vector. Essentially, you are winning market-share by using equity capital to give better credit terms; the brand is off loading its credit risk on your balance sheet. While there may be Fulfillment gaps today, but we think they are short term because large brands have market power and capabilities to bring their own fulfillment engine sooner or later. Plus, there is also threat from other players who are just building fulfillment — LogisticTech B2B companies.

On the flip side, working with a fragmented buyer base or from the demand side could allow a platform to command market power by aggregating demand and negotiating better terms with fragmented or consolidated supplier base. This is what building on Price vector could look like. While this thesis is very lucrative, it is very hard to execute, given the sheer volume or pace of execution (demand footprint) required, even more so if the supplier base is consolidated. In our view, Price could be at best a medium-term advantage if at all, the category has a demand aggregation play.

All in all, the more fragmentation, the better. It allows for you to sustain your competitive advantage over long term.

My colleagues and I will dedicate a whole piece talking about this in the next part of this series. I just want to stick to identification of opportunities for now and to helping you understand which vectors are at play.

Fragmentation further makes the India context even more appealing as Indian SMEs account for ~50% of all annual manufacturing exports and ~27% of GDP. Smaller business equals fragmentation. This coupled with the modularity enabled tailwinds mentioned above, we think it is an exciting time to build a B2B platform in India.

Summing it up and what`s next

We like B2B companies building in categories with fragmented supply side dynamics and consequently smaller supplier power.

Further, these companies leverage technology to provide value to their customers on Discovery & Quality, among other vectors.

In the next article of this series, we will take examples of a few categories and juxtapose value vectors across them. We will also go a little deeper and correlate operating metrics of B2B businesses, for example gross margins and working capital days across category-value vector choices. Idea is to go narrow, next

We are also very keen to learn what you think and potentially take inputs into making this research even better. We are hosting an open townhouse to brainstorm about B2B. No agenda. Just a free flowing white-boarding on Sunday evening. RSVP if you would like

.png%3Ftable%3Dblock%26id%3D0fc05530-04e6-4e8d-bec2-ef66f2be1f03%26cache%3Dv2?width=1500&optimizer=image)

.png%3Ftable%3Dblock%26id%3Db5f686e4-3836-4e04-8011-217ebb97aa8a%26cache%3Dv2?width=1500&optimizer=image)